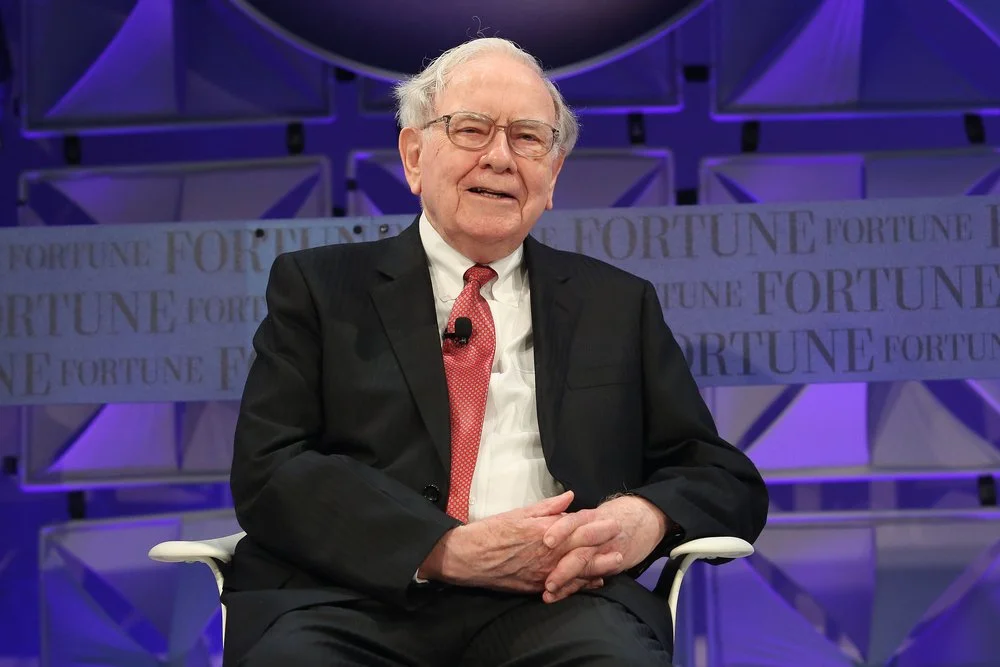

Warren Buffett did not build wealth by guessing trends or chasing hot stocks. He did it by trusting numbers. Real numbers. Clean numbers. Numbers that do not lie. His best rule sounds simple but cuts deep. Figures tell the truth. That idea guides every move he makes. It keeps emotion out and logic in. It turns investing from a gamble into a process.

This rule works because businesses run on cash, not headlines. Prices jump around, but earnings, debt, and cash flow expose reality. When you focus there, you stop guessing and start judging.

The Oracle of Omaha, 95, treats stocks like businesses, not lottery tickets. If the figures make sense, he buys. If they do not, he walks away. That mindset protects capital first. Growth comes second. This rule is why he sleeps well during market chaos and gets richer after it fades.

Focus on Intrinsic Value, Not Market Price

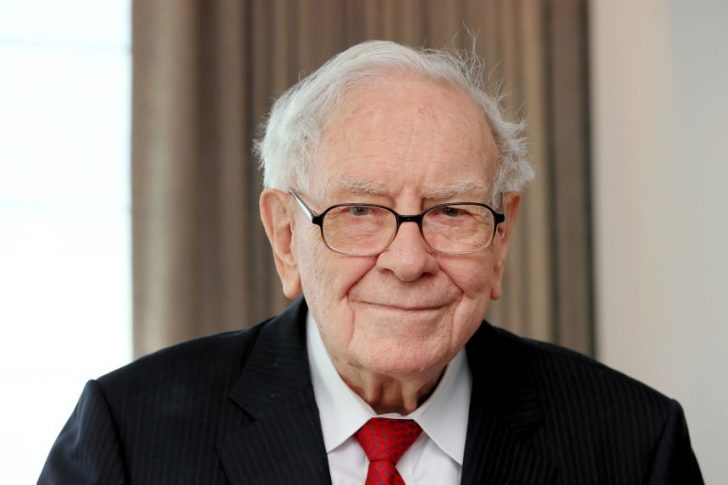

GTN / Buffett draws a hard line between price and value. Price is what the market screams today. Value is what the business earns over time. The gap between them creates opportunity.

He studies cash flow, steady earnings, and return on equity. These numbers show how well a company turns effort into profit. He avoids shaky balance sheets and heavy debt because debt hides risk.

Intrinsic value comes from future cash, not current hype. Buffett estimates what a business can earn years from now and discounts it back to today. If the price is lower than that figure, he pays attention. Market price reacts fast. Value moves slow. Buffett stays slow on purpose. That pace keeps him from overpaying and locks in long-term gains.

Insist on a Margin of Safety

Buffett never buys at fair value. He buys at a discount. That gap is his safety net. It protects him from mistakes and bad surprises. This idea comes from Benjamin Graham, his mentor. Buy with room for error. If you misjudge growth or face a downturn, the discount absorbs the hit.

The margin of safety turns caution into strength. It gives patience power. When markets fall, Buffett does not panic because he has already planned for trouble.

Many investors skip this step. They pay full price and hope. Buffett demands proof. If the figures do not offer a cushion, he passes without regret.

Understand the Business Before the Numbers

Figures only help if you know what they mean. Buffett invests inside his circle of competence. That means businesses he truly understands. When you know how a company makes money, the numbers speak clearly. You can tell strong growth from fake growth. You can spot risks early.

Marca / For years, Buffett avoided tech stocks. Not because he feared them, but because he could not explain them simply. That discipline saved him from costly errors.

He later bought Apple once he saw it as a consumer brand with loyalty and pricing power. The figures made sense because the business made sense.

Buffett does not trade. He owns. When he buys a stock, he sees factories, brands, and customers. Not a ticker symbol.

This view allows compounding to work its magic. Time multiplies good decisions. Short-term noise fades, but strong businesses keep earning.

His favorite holding period is forever for a reason. He trusts the original math. If the figures stay solid, he stays invested. Patience is easier when decisions start with truth. The numbers give confidence during dips. They turn volatility into background noise.

Ignore Market Emotion and Trust Your Math

Markets swing between fear and greed. Prices often move without reason. Buffett uses that chaos as a tool. When fear takes over, prices fall below value. Strong businesses go on sale. Buffett buys because the figures did not change; only emotions did.

When greed rules, prices float above reality. Buffett steps back. He knows inflated numbers are always correct. This approach feels lonely. It often looks wrong at first. But math beats mood over time. Every time.