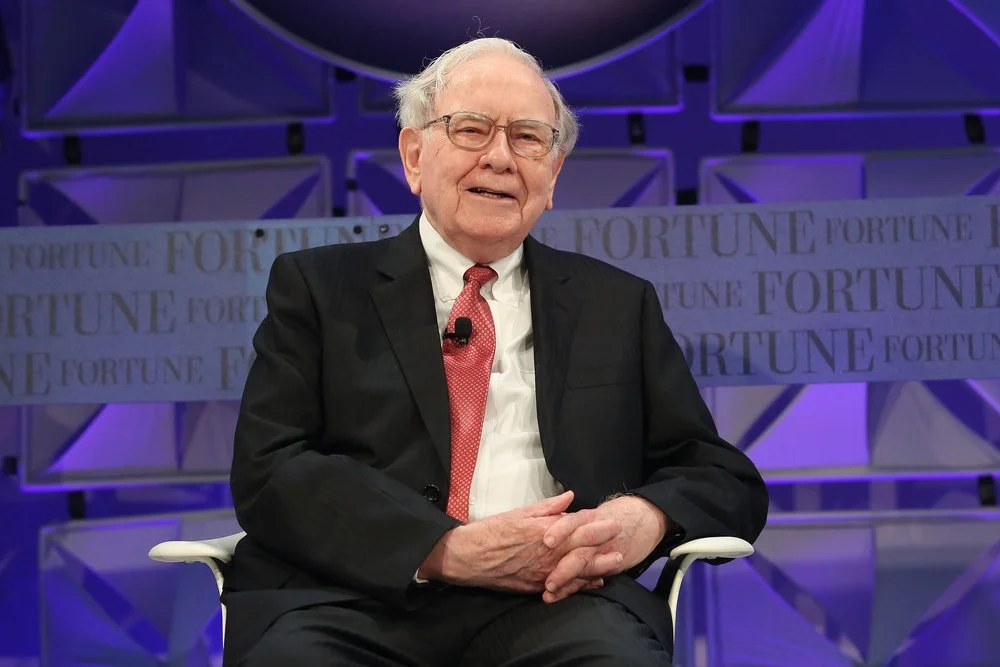

When people think of Warren Buffett, they picture calm logic, patience, and ice-cold discipline. That is why this story hits so hard. One of the most expensive mistakes in financial history started with something simple. Anger. In the early 1960s, Buffett was running a small investment partnership and spotted a beaten-down textile company called Berkshire Hathaway.

The 95-year-old Oracle of Omaha didn’t love the business. He just planned to make a quick profit and move on.

Buffett agreed to sell his shares back to the company at a set price. It was a handshake deal. When the written offer arrived, the price was slightly lower. Just 12.5 cents per share. That small insult flipped a switch. Buffett got mad, bought more shares, took control, and fired the CEO.

What followed was decades of capital trapped in a dying textile business. Buffett later said that an emotional decision cost shareholders over $200 billion in lost value. That number still stings.

Anchors Drain You, Enablers Multiply You

Bik / Pexels / The real lesson isn’t about textiles. It is more about where your money sleeps at night.

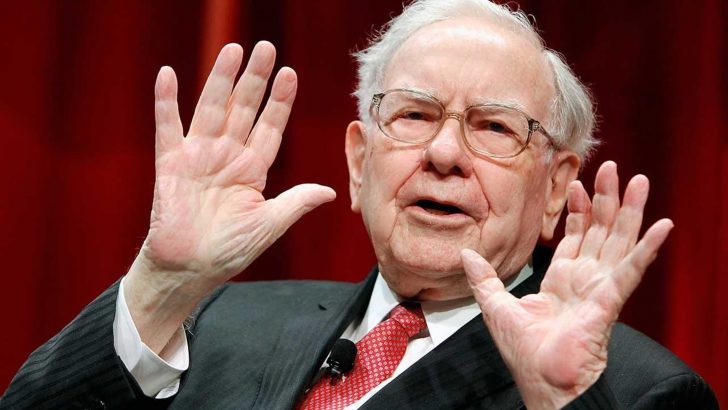

Berkshire’s textile operation was a financial anchor. It sucked in cash, demanded constant reinvestment, and gave nothing back. The industry had no pricing power, no moat, and no mercy. Every dollar that went in was a dollar that couldn’t go somewhere better. Buffett knew this. He just ignored it because emotion took over.

Years later, Berkshire bought insurance companies instead. That changed everything. Insurance created float, money paid in advance that could be invested for years. That float acted like fuel. It gave Buffett freedom, flexibility, and scale.

However, those businesses didn’t just avoid draining cash. They created more of it. Buffett later said if he had skipped the textile business and focused only on insurance, Berkshire might be worth twice as much today. That is the difference between an anchor and an enabler.

Build Financial Power, Not Financial Weight

Most people repeat this mistake on a smaller scale. They tie their money to things that look safe but quietly choke progress. Big houses with big payments. Cars that eat monthly cash. Subscriptions that never stop. Income flows in, then flows right back out.

Eca / Buffett’s textile mistake kept demanding more money just to survive. That is a red flag in any financial decision.

The fix starts with building your own version of float. That means money you don’t immediately need. Savings that aren’t earmarked for next month’s bills. Capital that gives you room to breathe and room to move. It doesn’t need to be complicated. It just needs to stay accessible and useful. When your money starts pulling its weight instead of dragging you down, stress eases quickly. Rash decisions tend to fade with it.

Cash Flow Tells the Truth Every Time

Anything that demands steady cash and gives nothing back is not an asset. It’s a liability with good marketing. Many people experience this through debt. Paychecks arrive, obligations drain them, and the pattern never changes.

Smart financial moves flip the direction. Cash gets pointed toward growth or protection of future income. That could be investing, education, or a business that doesn’t rely solely on your time. The test is simple. Will this choice improve future cash flow or shrink it? Buffett failed that test once and learned the hard way. You can skip that lesson.