In September 2022, Ecuador announced that it had started a new dialogue regarding debt relief restructuring deals with Chinese banks. Should the deal be successful, the agreement is estimated to be worth around $1.4 billion and will be in effect until 2025. This is because China is continuously providing bailouts to countries that are at risk of financial crises. Ecuador President Guillermo Lasso, a center-right politician, stated that they’d reached an agreement with the Export-Import Bank of China and the China Development Bank, which is valued at $1.4 billion and $1.8 billion.

EPA/Chris Ratcliffe/Pool | The goal behind these deals is to extend the maturity of the loans while reducing interest rates and amortization

The Deal With China

These agreements are set to provide $1.4 billion in debt service relief, and the repayments will be lowered by more than $775 million in the upcoming three years to the China Development Bank. On the other hand, the repayment, which will be done to China Eximbank, will be reduced to $680 million by the year 2025. Ecuador President, Guillermo Lasso, stated that with the help of these agreements, the maturities had been extended to 2027 for the China Development Bank, and for the China Eximbank, the maturity has been extended to 2032.

John/Pexels | This will help and allow the cash flow relief to support the government's priorities.

Not Everyone’s Happy

The South American country might be getting bailouts, but it has been receiving quite the backlash from Ecuador’s economists. This government has been looking into restructuring its debts with China since February of this year. China has been one of the more important financial partners for the past decade because of leftist former president Rafael Correa. However, this financial partnership has landed Ecuador into an $18 billion loan since 2007. Many economists aren’t too happy about the growing dependency on China and the high interests that come with loans.

This is not something new for China, which has been distributing billions of dollars in the name of emergency loans to the countries in recent years in bailouts. This has placed Beijing as one of the leading competitors of the IMF. The countries that have taken this rescue lending include Argentina, Pakistan, and Sri Lanka. Since 2017, $32.83 billion has been sent out by China as emergency loans, according to the data compiled by AidData.

This debt restructuring has put President Lasso in the good books of his fellow citizens as the protests have weakened across the country and the Analysts have called this a political win. They see this as a positive deal where there are signs of active state role and more active state spending. Currently, Ecuador is also working towards a free trade agreement with China and it hopes to finalize it at the China-Latin America and the Caribbean business summit.

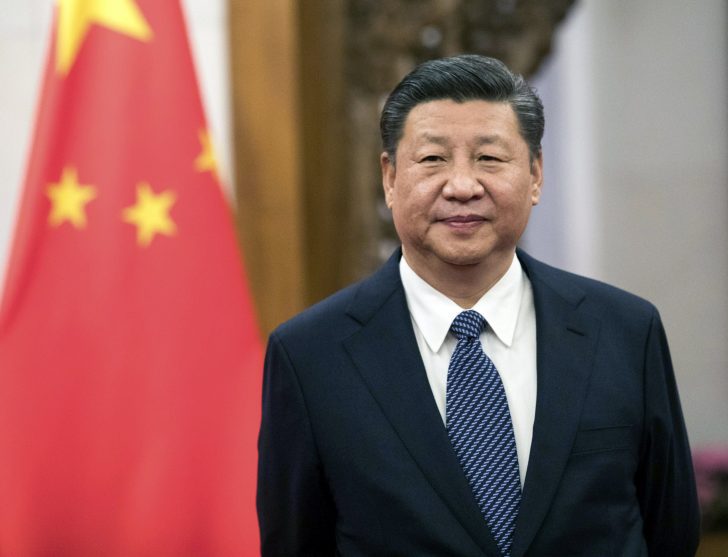

Getty Images | The summit is set to take place in December of this year.

There’s no doubt that China has gradually grown from being just a regional power to a force to be reckoned with. It is countries like Ecuador that are benefiting from a rising power.