Do you feel like managing your finances has become increasingly difficult in the face of an economic downturn? You are not alone. COVID-19 and its various associated restrictions have posed financial challenges for many Americans.

Consequently, this has left them uncertain of how to go about their day-to-day spending and long-term goals. Whether your income has suffered or increased, it is important now more than ever to begin considering ways that you can manage your finances during such challenging times.

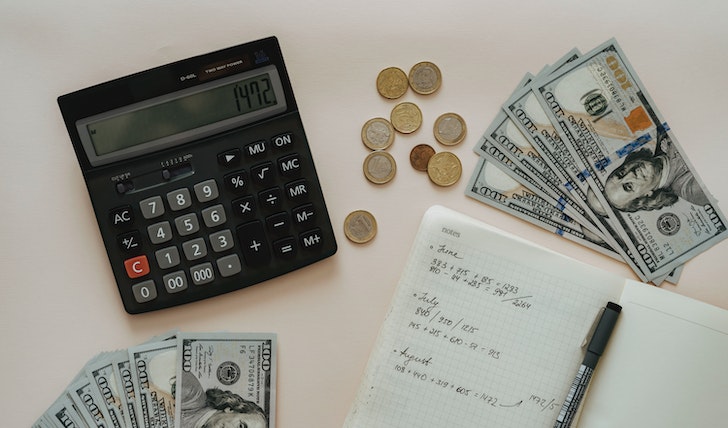

Andrea / Pexels | In this post-covid era, average Americans are on the verge of a financial recession.

This article will provide practical tips on how average Americans can make the most out of their financial situation amidst any economic crisis.

Create a Budget & Track your Spending to stay on Top of your Finances

Managing your finances can be a daunting task, but establishing a budget and keeping track of your spending is essential to staying on top of your financial health.

Creating a budget allows you to allocate your money toward your priorities and monitor your spending. Tracking your spending will give you a clear understanding of where your money is going and help you identify areas where you can cut back.

Olia / Pexels | To better manage your finances (amidst a financial recession,) make sure to keep a fair track of your spending.

So, take control of your finances by making a budget and holding yourself accountable for your spending. With a little effort and discipline, you can achieve financial stability and peace of mind.

Cut Back on Unnecessary Expenses & Look for Ways to Save Money

Looking for ways to save money may seem like a daunting task, but it can actually be quite empowering once you start cutting back on unnecessary expenses. You can save a decent amount of money by:

- Canceling a subscription you never use

- Cooking at home more often

- Shopping for deals.

In the long run, these small changes can add up to big savings over time. It is also important to stay mindful of your spending habits and to ask yourself if each purchase is truly necessary.

Andrea / Pexels | To help manage your finances, make sure to save every single cent!

By being intentional with your money, you will have not only more financial stability but also a greater sense of control over your life.

Research Different Banking Options & Consider Using Online-only Banks

If you are in the market for a new bank, it is important to research and explore all your options. Online-only banks are becoming an increasingly popular choice for those looking for convenience and flexibility. Ideally, online banks are often able to offer higher interest rates and lower fees than traditional brick-and-mortar banks.

Plus, many online-only banks have user-friendly mobile apps and online platforms. Consequently, making it easy to manage your finances on the go. So, make sure to give it a try!

Take Advantage of Low-interest Credit Cards

With interest rates at historic lows, you could save big on interest charges by taking advantage of these offers. Low-interest credit cards can offer introductory rates as low as 0%. Consequently, this will allow you to make purchases without incurring any interest charges.

Alternatively, refinancing a loan at a lower rate could save you thousands of dollars in interest charges over the life of the loan.