Mortgage rates have been a hot topic lately, and with good reason. Despite the persistent inflation and the Federal Reserve's decisions on interest rates, homebuyers are still waiting for a break. With May 2025 on the horizon and market conditions...

top in

Wisdom

all articles in Wisdom

Mortgage rates move up and down all the time - and there is nothing you can do to change that. They depend on the economy, inflation, the Fed, and other things that don’t care how ready you are to buy...

Conventional wisdom says a mortgage should be paid off before retirement. If you can swing it, great! But real life is not always that simple. Nearly 40% of retirees still carry a mortgage, with an average balance of over $100,000....

The idea that mortgage credit is strong and stable couldn’t be more misleading. Many assume that tighter regulations since the 2008 crisis have made the system foolproof, but that belief rests on shaky ground. When you break down the numbers,...

Mortgage demand, a reliable barometer of the housing market's health, has taken a dramatic nosedive. As 2024 drew to a close, a sharp rise in interest rates pushed many potential buyers and refinancers to hit pause on their plans. According...

Rising interest rates have made car loans less affordable, leaving many buyers reconsidering their plans. However, recent economic shifts suggest that relief may be on the horizon, with used car interest rates showing signs of gradual decline. For buyers, this...

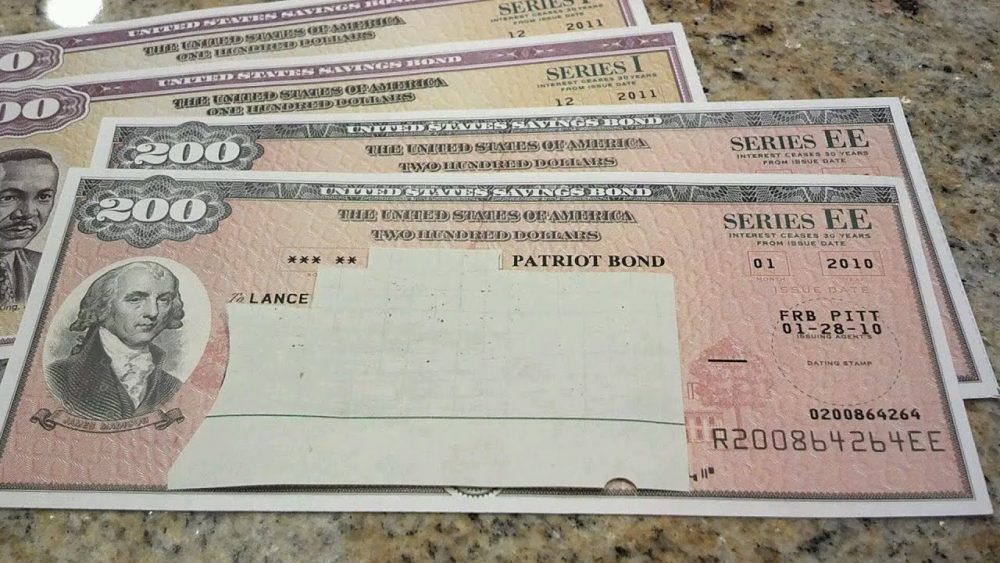

When the economy gets unpredictable, finding a safe place for your money can feel tricky. Series I Savings Bonds offer a solution. These inflation-protected bonds are not only safe but also offer high returns, making them a top choice for...

Taking out a personal loan can feel like a quick fix for financial needs, from home improvements to unexpected expenses. However, without a clear strategy, that "simple solution" can quickly become a long-term burden with high interest rates, hidden fees,...

When buying a home, navigating the mortgage process can feel overwhelming. The options are numerous, and understanding the terms and conditions can be complicated, especially for first-time buyers. This is where a mortgage broker can make all the difference. But...

The rise of Airbnb has revolutionized the short-term rental market, leaving many homeowners wondering if they can rent their houses on Airbnb if they have a mortgage. This question is crucial for those looking to capitalize on the growing demand...

If you're considering a personal loan but facing challenges securing favorable terms or qualifying for one, exploring where to get a loan using your car as collateral might be a viable solution. This approach, which involves leveraging your vehicle’s value,...